How to design a business sales invoice

The sales invoice.

Quite simply one of the most important documents in your business. After all, without it, how do you expect to get paid for your work!

Depending how long you’ve been in business, you may have experienced the evolution of the sales invoice.

Before online bookkeeping software was such common practice, before we all had an email address and before we were all online, sales invoices would usually be hand written into a duplicate book, with the top sheet tore off and handed to the customer.

Imagine that!

Maybe, you’re still there with your invoicing process, we’re not judging 🙄 you can embrace the digital world when you’re ready.

We’ll be waiting for you with open arms!

But really, no matter how it was made, whether etched into a piece of rock or not, invoices have always had to stick to some key fundamentals.

So what should be included and how should it look…

WHAT SHOULD BE INCLUDED

Your sales invoices should include:

- Your business name / trading name – it can include both i.e. “Overworked Creative Genius”, “Overworked Creative Genius is a trading name of Creative Media4U Ltd”

- Your business address

- Business logo (if you have one, but not essential, although it helps the professionalism of your work and enforces your brand)

- Customer Name and Address – if you’re supplying goods or a physical service, you may also want to add a delivery address if different to billing address

- Invoice number (for best practice this should increment by +1 each invoice, so that each invoice has a unique number)

- Date / Tax Point – absolute essential

- VAT Number (if you are VAT registered)

- Payment information (Bank details, payment terms)

- Detail and breakdown of the goods/service provided

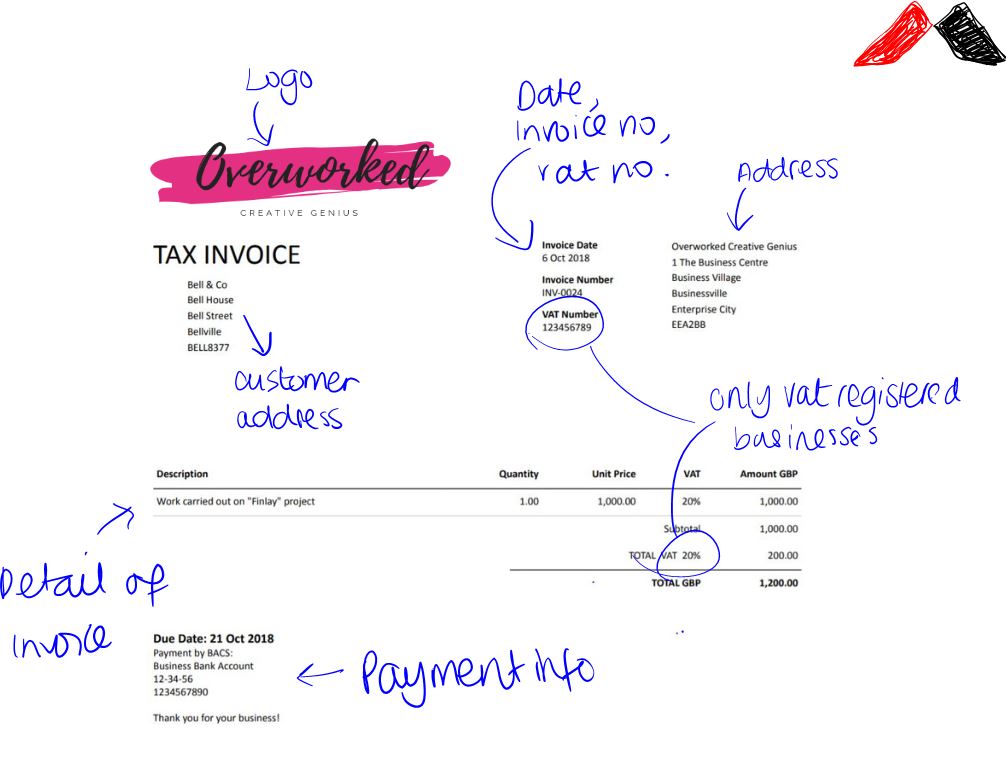

HOW SHOULD IT LOOK

There are many free templates online that satisfy layout and design needs.

However, here’s an example of an optimum design:

You should get comfortable with your invoicing system and shout for help from your accountant if it’s not working for you.

With cloud bookkeeping such as Xero and Quickbooks you can invoice from anywhere with an internet connection so you can invoice customers on the go from your smart phone, setup repeating invoices for recurring regular works, and you can email the invoice straight from the app, meaning no printing or saving down and attaching to emails.

You can also add payment links to your invoices, when you’re invoicing online. See our other post on online payment solutions for your business.

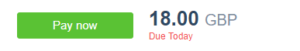

Here’s an example of what a payment link looks like:

Then when your customer clicks through the payment link, they will see an overall view of the invoice, with a pay now button:

This pay now button hooks up to your online payment provider, whether that be PayPal, Stripe, GoCardless etc.

Meaning, your customer can pay faster and easier….

Some other tips for invoicing which are often forgotten.

Invoice promptly

If you think about it logically, the sooner you invoice, the sooner you will be paid. If you are tardy with invoicing, say you let it build up and only do it once or twice a month, the customers who you’re invoicing are going to respond in the same way.

So, getting paid on time is going to be difficult. If you are invoicing on completion of a job, or you are invoicing upfront – be sure to do so.

Stick to your initial agreement terms you setup with the customer before you started. Your customer will expect it.

Follow up

When an invoice looks as though it’s going overdue, or has gone overdue, get in touch with your customer.

Preferably over the phone if you can.

Studies show that being polite while requesting payment has a high success rate. Sometimes there are reasonable explanations.

If you’re tardy at this stage, the customer is going to be lax in settling the overdue debt with you.

Don’t chase a paid invoice

There’s nothing worse than chasing a customer for payment who has recently paid!

It’s easily done when you’re using a manual system for keeping a tally on who owes you what.

Just make sure you keep this up to date.

Before you pick up the phone to chase for debt, make sure you’ve checked your bank and payment providers for any recent customer payments.

Send your invoice to the person with the purse string

Make sure when you’re emailing your invoice for payment, that you email the person who has the authority to approve and make payments.

Check your terms with your customer, they may have provided alternative contact details for billing.

Getting this right, saves your invoice being passed around on an email string for a couple of days, hitting every Tom, Dick and Harry’s inbox before finally been dealt with by Mary in billing.

If you’d like help getting your invoicing into better shape, give us a shout.

We’d love to help make invoicing easier for you 🙌